Social security offset calculator

If youd like to have a Social Security representative speak at a lunch and learn seminar Employee Benefits seminar pre-retirement seminar or conference please visit our Request a Speaker page. This phase-out of the WEP reduction offers a great planning opportunity if you have worked at a job where you paid Social Security tax.

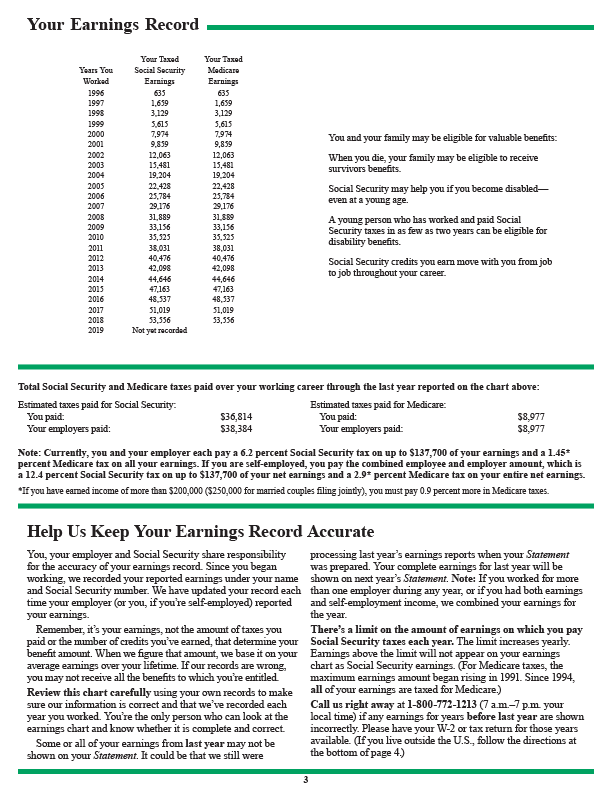

Analysis Of Benefit Estimates Shown In The Social Security Statement

Their higher burden is partially offset by a law that allows them to take half of what they pay in Social Security taxes as an income tax deduction.

. There is a Social Security government pension offset. This like WEP will prevent them from double dipping. Paying income tax on Social Security benefits.

A similar rule the Government Pension Offset GPO affects spouses widows and widowers who collect spousal or survivor benefits from Social Security and also receive pensions from federal state or local government jobs that did not withhold Social Security taxes. In the past there were exceptions in some states where the amount of unemployment compensation was offset by some of the social security benefits that were received. Government Pension Offset GPO Restricted application and deeming rules Alternate widowers benefits when the deceased spouse died before age 62.

If you do not have 30 years of Social Security covered work a Social Security WEP Calculator can assist you to calculate the complex formula that will tell you your benefit amount. Pensions from work not covered by Social Security. The GPO will also reduce survivor benefits you are collecting on the work record of a deceased spouse if.

Another 145 percent of your gross wages helps fund Medicare. FERS Retirees Are Eligible to Collect Social Security and a Supplement if They Retire Early. Easy-to-Use Social Security Calculator.

145 of every 100 you earn goes to Medicare. The calculation hasnt worked correctly since it was implemented in 1977. The Government Pension Offset applies to individuals who are looking to collect spousal benefits but receive a government pension.

Using the calculator below enter the estimated gross monthly amount of. Yes although a Social Security rule called the Government Pension Offset GPO will reduce your spousal benefits if your pension is from a non-covered government job in which the FICA taxes that largely fund Social Security were not withheld from your paycheck. The Social Security Administrations life expectancy calculator can help you decide.

Any pension you receive from work. Full unemployment insurance benefits are available for eligible workers who are collecting social security in most states. In a lump-sum settlement you agree to give up certain rights so that you can.

Thats true whether you are getting workers comp in installments or as a lump-sum settlement. For an eligible beneficiary who claims Social Security upon reaching full retirement age in 2022 the highest possible monthly payment is 3345. This document will help you understand how pensions based on such earnings affect Social Security benefits.

In contrast to other forms of social assistance individuals claims are partly dependent on their contributions which can be considered insurance premiums to create a common fund out of which the. After you reach age 62 for every year you postpone taking Social Security up to age 70 you could receive up to 8 more in future monthly payments. The Social Security Act directs the agency to apply the GPO and the discount for early retirement in the wrong order.

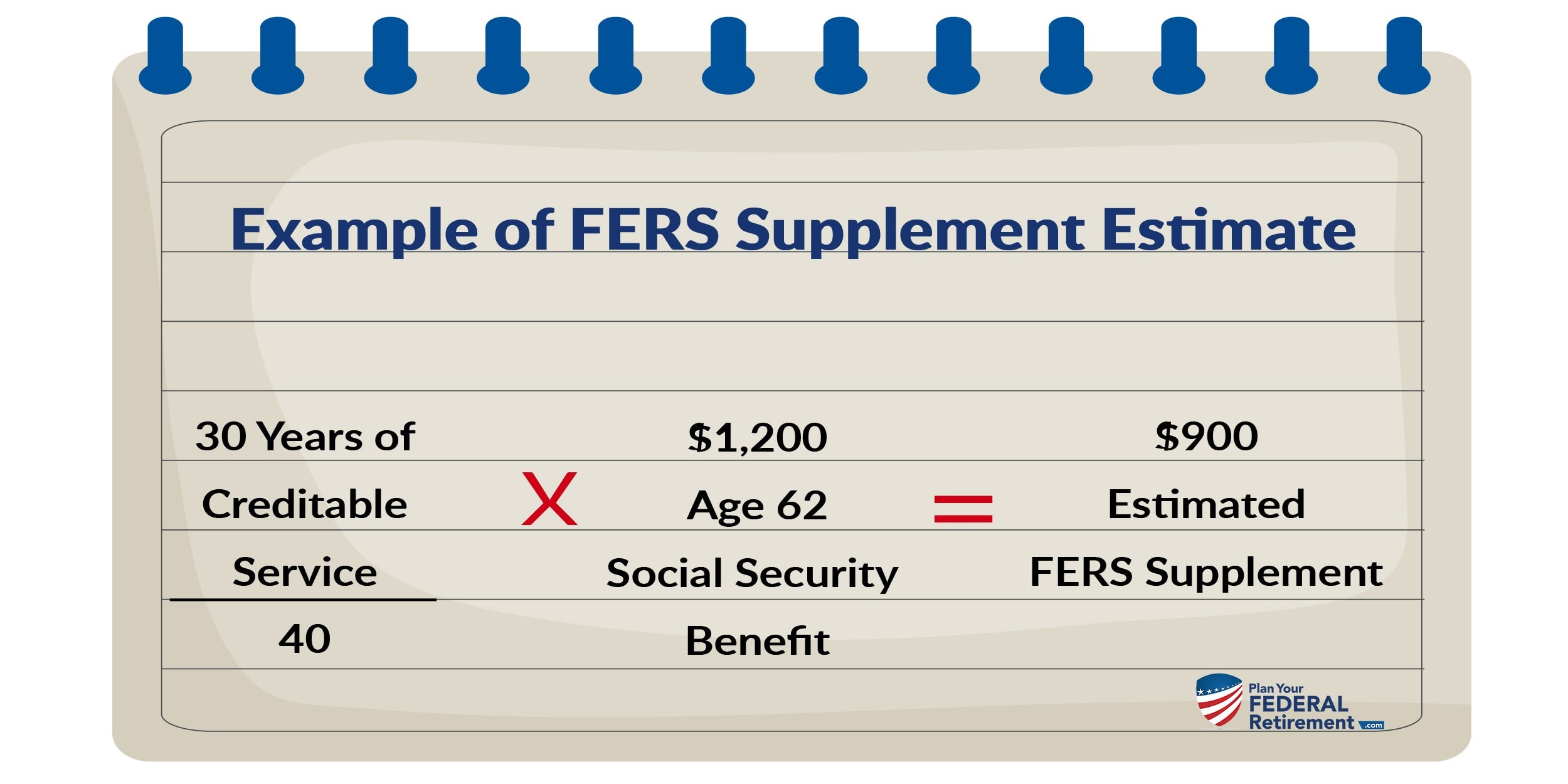

In addition the formerly widespread practice of states deducting money from unemployment benefits if a recipient also received Social Security has been eliminated nationwide. FERS employees who retire After their Minimum Retirement Age MRA with 30 years of service will receive a Special Retirement Supplement which is paid as an annuity until you reach age 62 and become eligible for Social Securit y. When it comes to calculating a start date for Social Security benefits however theres not an age that.

The Social Security Trustees annual report estimates that taxes on Social Security will total 451 billion in 2022 up from 345 billion in 2021. In the early 2000s 20 states and the District of Columbia had such Social Security offset laws according to the National Employment Law Project NELP. Making the most of Social Security requires some strategy to take advantage of the basic benefit rules however.

These benefits are reported to you on Forms SSA-1099 for Social Security and RRB-1099 for Railroad Retirement benefits. Social Security benefit rules are different for people who had a job that was not covered by Social Security and receive a pension because of that job. If you work or have worked for a company that gives you a pension based on work not covered by Social Security the basic calculators above arent an accurate representation.

Social Security benefits received This is the total of all Social Security and equivalent Railroad Retirement benefits you and your spouse if you are married filing jointly received in 2022. News and opinion from The Times The Sunday Times. With the Debt Collection Improvement Act of 1996 the government allowed for garnishment of Social Security benefits but set a limit on how much can be offset.

Collecting Social Security and Unemployment. The Windfall Elimination Provision. Your Social Security benefits as a spouse widow or widower might be reduced if you get a pension from a government job where you did not pay Social Security taxes.

Theres no income maximum there. While you can receive Social Security Disability Insurance benefits and workers compensation for the same disability the amount of workers compensation can reduce your SSDI. This offset is the Government Pension Offset or GPO.

If a worker covered by Social Security dies a surviving spouse can receive survivors benefits if a 9-month duration of marriage is met. Per the act the government cant take any more than 15 of your Social Security payments nor can it leave you with less than 750 in monthly benefits. Skip advert There are ways you can lower.

The insurance may be provided publicly or through the subsidizing of private insurance. Once you reach age 70 increases stop so there is no benefit to waiting past age. The Social Security calculator will take into consideration the amount of your TRS pension and then decrease the amount of your Social Security by a factor.

Using this calculator it is possible to estimate net Social Security benefits ie estimated lifetime benefits minus estimated. For example if you worked as an engineer for 20 years before you began teaching you may be able to do enough part time work between now and when you retire to completely. To draw the highest possible benefit you must have earned at least the maximum taxable earnings the amount of income subject to Social Security taxes for 35 of your working years.

Social insurance is a form of social welfare that provides insurance against economic risks. Handles all Social Security benefits for ALL households. The Windfall Elimination Provision WEP affects members who apply for their own not spousal Social Security benefits.

Their benefits are reduced by two-thirds of their government pension and. The Social Security WEP Calculator.

The Long Term Benefits Of Delaying Social Security

How Much Will I Get From Social Security

Social Security Disability Benefits Claims In New Jersey

Long Term Disability Income Offsets Explained Cck Law

Long Term Disability Income Offsets Explained Cck Law

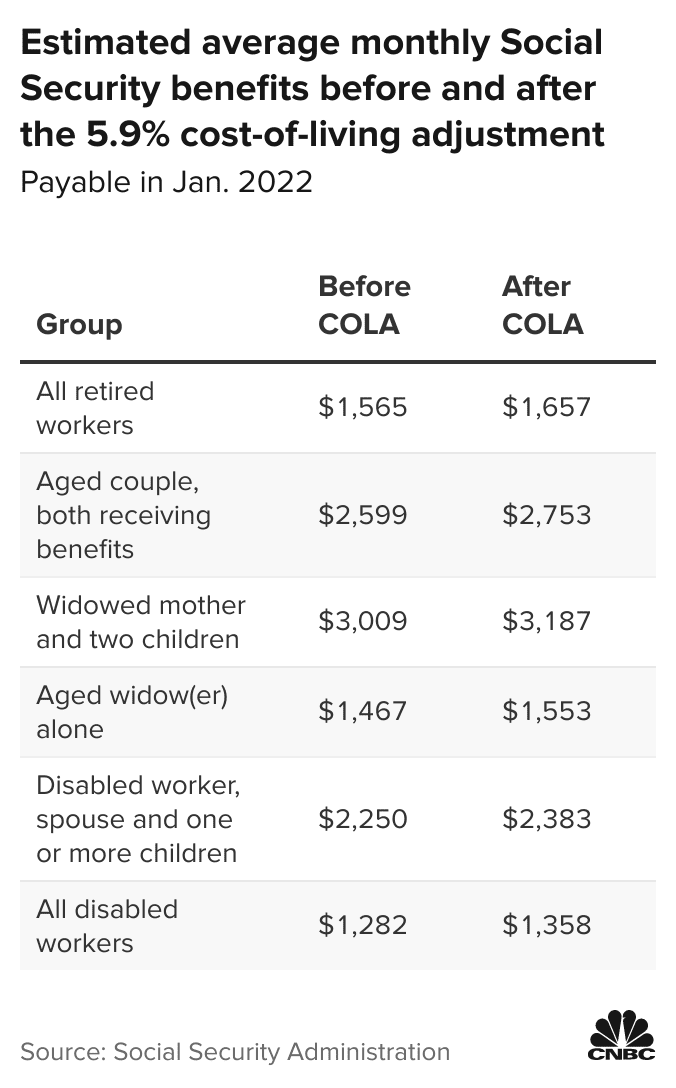

Social Security Cola How To Estimate Your Monthly Payments For 2022

A Primer On Pension Valuation In Divorce

Social Security Ppt Download

Analysis Of Benefit Estimates Shown In The Social Security Statement

Long Term Disability Income Offsets Explained Cck Law

The Long Term Benefits Of Delaying Social Security

Long Term Disability Income Offsets Explained Cck Law

The Long Term Benefits Of Delaying Social Security

Fers Supplement Plan Your Federal Retirement

The Long Term Benefits Of Delaying Social Security

Analysis Of Benefit Estimates Shown In The Social Security Statement

Qcdjokvuaffim